Buying a Put and Selling another Put lowers the cost but there are other benefits too. The time decay and volatility is sort of neutralized since the long and short position cancels out each other. Even if the price doesn’t change time decay won’t take a bite out of your position.

Another advantage whit debit spreads is that you will know ahead of time the Maximum Profit and the Break-Even Point at expiration. For as long as your position is open these parameters won’t change. Depending on how you choose the strike prices the Break-Even Point could be very close to the current price. This way even if the stock only slightly moves you can still make money.

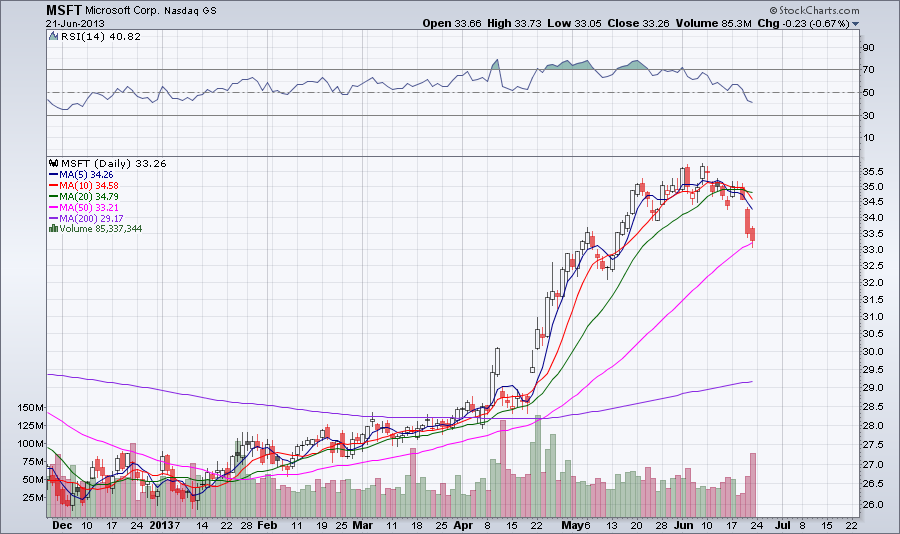

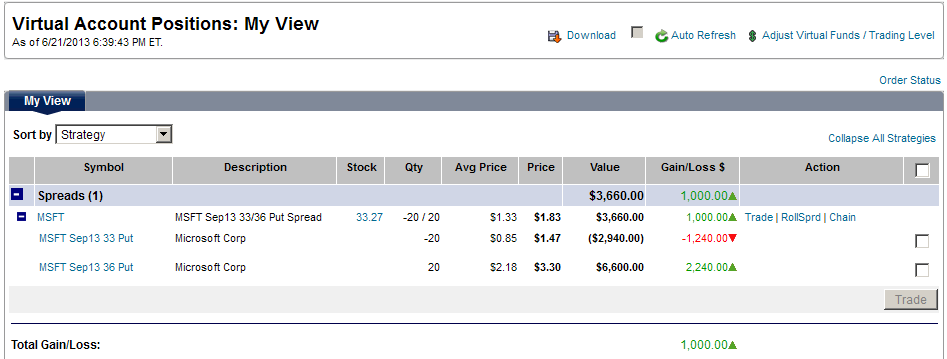

In the current example I used my Virtual Trading account to open this position. I bought 20 MSFT Sep 13 33/36 Put Spread for 1.33 Net Debit each. The total cost was 1.33x100x20 = $2660. The Maximum Profit = (36-33)-1.33x100x20 = $3340 which is 125%. The Break-Even Point is 36-1.33 = $34.67. I entered this position on 6/12/2013 when MSFT closed at $35.00. In this case as you can see if the price moves down more than 1% until September we are going make money. Today, when MSFT closed at $33.26 the value of this position is 1.83 for the total of $3660. It already made $1000 or 37% in 9 days.

If this was real money in a real account I would probably exit the trade and take the profit. For now in my Virtual Account I will leave this trade open since I see further weakness during the next few weeks.

RSS Feed

RSS Feed