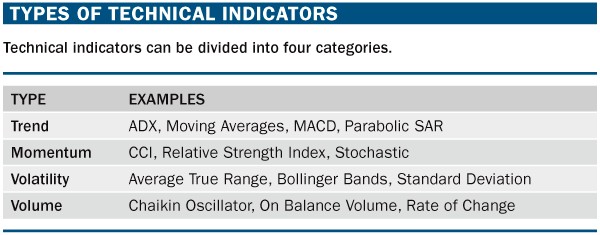

- Trend indicators - they meaure the direction and strenght of the trend

- Momentum indicators - they tell us about the speed at which prices change

- Volume indicators - they are based on calculations which tells how much volume changes with price movements

- Volatility indicators - helps to determine the volatility, the higher the volatility the riskier the security

|

Technical indicators are trading tools which can be very uselful if they are used properly. Indicators use various mathematical calculations to visualize certain characteristics of past and current price movements and volume changes. There is a large number of indicators which makes it very difficult to decide which ones to use. Novice chartists often put too many indicators on their charts with often redundant information. This also makes it difficult to make a quick decision. Indicators can be grouped in for different groups:

8 Comments

4/13/2022 04:57:26 am

I very much appreciate it. Thank you for this excellent article. Keep posting!

Reply

12/20/2022 09:15:10 pm

İnstagram takipçi satın almak istiyorsan tıkla.

Reply

1/8/2023 01:50:07 am

100 tl deneme bonusu veren siteleri öğrenmek istiyorsan tıkla.

Reply

6/30/2023 09:53:45 am

En iyi bayburt ilan sitesi burada. https://bayburt.escorthun.com/

Reply

Leave a Reply. |

Loading

Search Site

Links

Archives

September 2014

Categories

All

|

RSS Feed

RSS Feed